1. Futures Muted as Markets Remain Cautious

U.S. stock futures wavered on Tuesday, reflecting investor caution ahead of key economic data and Nvidia’s (NASDAQ: NVDA) quarterly earnings report later this week.

As of 05:38 ET (10:38 GMT), the Dow futures contract edged down by 23 points (-0.1%), S&P 500 futures shed 13 points (-0.2%), and Nasdaq 100 futures dipped by 83 points (-0.4%).

Wall Street closed mixed on Monday:

- S&P 500: -0.5%

- Dow Jones Industrial Average: +0.1%

- Nasdaq Composite: -1.2%

Investor sentiment remains fragile amid concerns over trade tensions and economic uncertainty. Reports indicate that the Biden administration may tighten controls on semiconductor technology exports to China, impacting major chipmakers like Nvidia.

2. Trump Reaffirms Tariff Plans on Canada and Mexico

President Donald Trump reiterated on Monday that the U.S. will proceed with 25% tariffs on imports from Canada and Mexico, despite the two nations implementing stricter border security measures.

Earlier in February, Trump had postponed the tariffs until March 4 after Canada and Mexico pledged to intensify efforts to curb fentanyl trafficking. However, the president did not confirm whether the tariffs would officially go into effect on that date.

The move could impact more than $918 billion worth of imports, potentially disrupting North America’s deeply integrated economy. Trump also emphasized his broader goal of imposing “reciprocal” tariffs to counter trade imbalances.

3. Conference Board Consumer Confidence Report Due

Economists anticipate that U.S. consumer confidence weakened for a third consecutive month in February, with the Conference Board’s index projected to drop to 102.7 from 104.1 in January.

Key economic indicators suggest a slowing economy:

- Retail sales: Declined sharply in January

- Consumer sentiment: Worsened due to inflation worries

- Inflation expectations: Reached a 15-month high

A University of Michigan survey found that many households fear Trump’s tariff plans could further drive up prices. Despite these concerns, analysts at Vital Knowledge believe that while the data raises “red flags,” the broader economic backdrop remains stable.

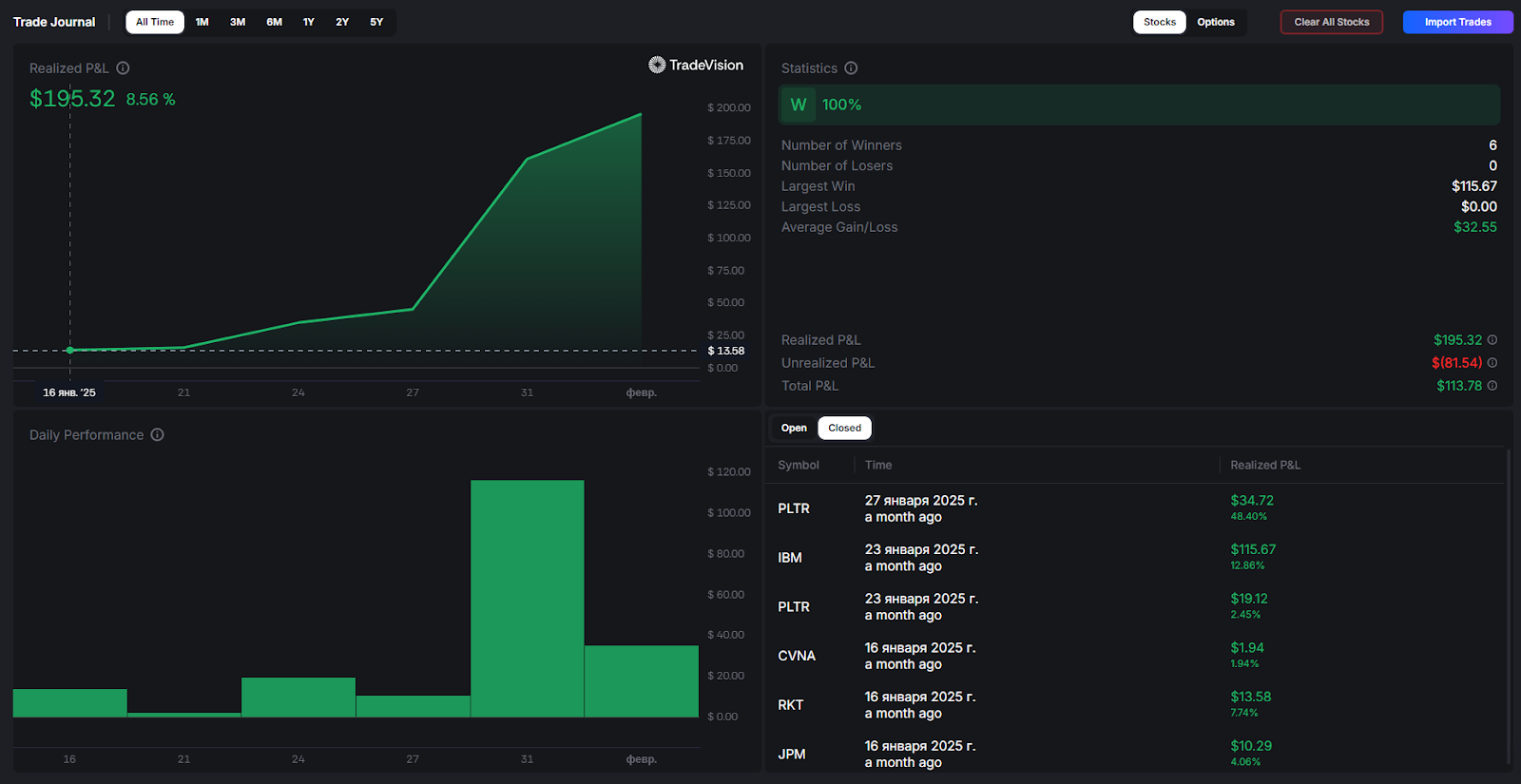

Adapt and optimize your trading strategy in real time with TradeVision‘s powerful trading journal feature. Track your trades, analyze performance trends, and make data-driven decisions to stay ahead in any market condition.

4. Fed’s Logan Proposes Auctioning Discount-Window Loans

Dallas Federal Reserve President Lorie Logan suggested that the Fed should allocate a “modest share” of its long-run balance sheet to loans or repos to enhance monetary policy efficiency.

During a conference in London, Logan proposed daily auctions of discount-window loans, which could:

- Improve banks’ operational readiness

- Normalize borrowing from the Fed

- Facilitate smoother reserve redistribution in the banking system

Although the Fed has encouraged banks to use discount-window loans, many institutions remain reluctant, fearing it could signal financial distress. Some officials worry this perception could limit liquidity options for smaller banks and the broader financial system.

5. Gold Hovers Near Record High

Gold prices dipped slightly in early European trading on Tuesday but remained close to all-time highs as investors sought safe-haven assets amid trade concerns.

The precious metal surged overnight after Trump reaffirmed his tariff stance on Canada and Mexico. Meanwhile, oil prices edged higher following new U.S. sanctions on over 30 brokers and shipping firms involved in transporting Iranian crude, raising concerns over global supply constraints (Kitco).

Summary

- U.S. stock futures indicate a cautious open as Nvidia’s earnings approach.

- Trump reaffirmed 25% tariffs on Canadian and Mexican imports, affecting $918 billion in trade.

- Consumer confidence is expected to decline for the third consecutive month.

- Fed’s Logan suggested auctioning discount-window loans to improve monetary policy effectiveness.

- Gold prices remain near record highs amid market uncertainty.

With geopolitical and economic uncertainty looming, investors remain vigilant ahead of key earnings reports and upcoming economic data releases