If you’re new to trading, you might be wondering how some of the best mutual funds of 2024 managed to outperform the market. The secret? Many of these funds heavily invested in the “Magnificent Seven” — tech giants like Nvidia, Apple, Alphabet, and Microsoft. These companies alone accounted for more than half of the S&P 500’s total returns. But what does this mean for 2025? Let’s break it down in simple terms and explore how you can learn from these strategies.

Why the Magnificent Seven Dominated 2024

In 2024, large-cap funds that bet on the Magnificent Seven soared. Funds that didn’t invest in these tech titans missed out. While the S&P 500 gained 25% (including dividends), the average large-cap fund returned just 21%. Only 25% of large-cap managers beat the market, which is below the historical average of 40%, according to Morningstar.

Small- and mid-cap funds performed better because they weren’t as affected by the dominance of the Magnificent Seven. Mid-cap funds returned 13.4%, while small-cap funds matched the Russell 2000 index with an 11.3% return.

What to Expect in 2025

Beating the market in 2025 might be tougher. Large-cap stocks are expensive, and the tech sector makes up 41% of the S&P 500, creating a high concentration risk. Michael Cuggino, manager of the Permanent Portfolio Aggressive Growth fund, advises caution: “Unless something is real cheap, you might want to wait for a pullback. Get your shopping list prepared and wait for the right moment.”

Other factors to watch include:

- Economic Policies: The impact of Donald Trump’s presidency and potential policy changes.

- Bond Market: Rising bond yields could pressure stock valuations, especially for high-priced tech stocks.

Where Are Fund Managers Finding Value?

Despite the challenges, top fund managers see opportunities in:

- Artificial Intelligence (AI): Companies like Nvidia and Broadcom continue to lead in AI innovation.

- Energy and Materials: Beaten-down stocks in these sectors could rebound.

- Banks and Travel: Regional banks and travel companies like Expedia and Royal Caribbean are undervalued.

- Copper: Freeport-McMoRan is a top pick for its role in green energy and manufacturing.

Top Mutual Funds to Watch

Here are some of the best-performing funds of 2024 and their strategies:

1. Permanent Portfolio Aggressive Growth

- Manager: Michael Cuggino

- Strategy: Concentrated portfolio with a focus on tech (41% allocation). Top holdings include Nvidia, Broadcom, and Palantir.

- 2024 Return: 44.5%

- Contrarian Pick: Copper via Freeport-McMoRan.

2. Bridgeway Aggressive Investors 1

- Strategy: Focus on value, quality, and sentiment. Top holdings include Nvidia, Microsoft, and Apple.

- 2024 Return: 35.8%

- Undervalued Sectors: Travel (Expedia, Royal Caribbean) and regional banks (East West Bancorp, First Horizon).

3. Spirit of America Large Cap Value

- Strategy: Stable portfolio with a 36% tech allocation. Top holdings include Nvidia, Apple, and Microsoft.

- 2024 Return: 33.3%

- Utilities Play: Constellation Energy and Vistra benefit from AI’s energy demand.

4. Schwartz Value Focused

- Strategy: Heavy focus on energy (65% allocation). Top holding is Texas Pacific Land, up 115% in 2024.

- 2024 Return: 12.7% (10-year average beats 99% of peers).

- Energy Outlook: Oil and gas remain critical despite green energy trends.

5. Hennessy Cornerstone Growth

- Strategy: Small-cap focus with a price/sales ratio below 1.5. Top sectors include industrials (30%) and healthcare (15%).

- 2024 Return: 11.8% (15-year average beats 94% of peers).

- Construction Boom: Tutor Perini and Emcor benefit from onshoring and supply chain investments.

Key Takeaways for New Traders

- Diversify: Don’t put all your eggs in one basket. While tech dominated 2024, other sectors like energy, travel, and construction could shine in 2025.

- Be Patient: Wait for pullbacks to buy quality stocks at better prices.

- Watch Expenses: High expense ratios can eat into returns. Look for funds with reasonable fees.

- Stay Informed: Keep an eye on economic policies, bond yields, and sector trends.

Tradevision Approach

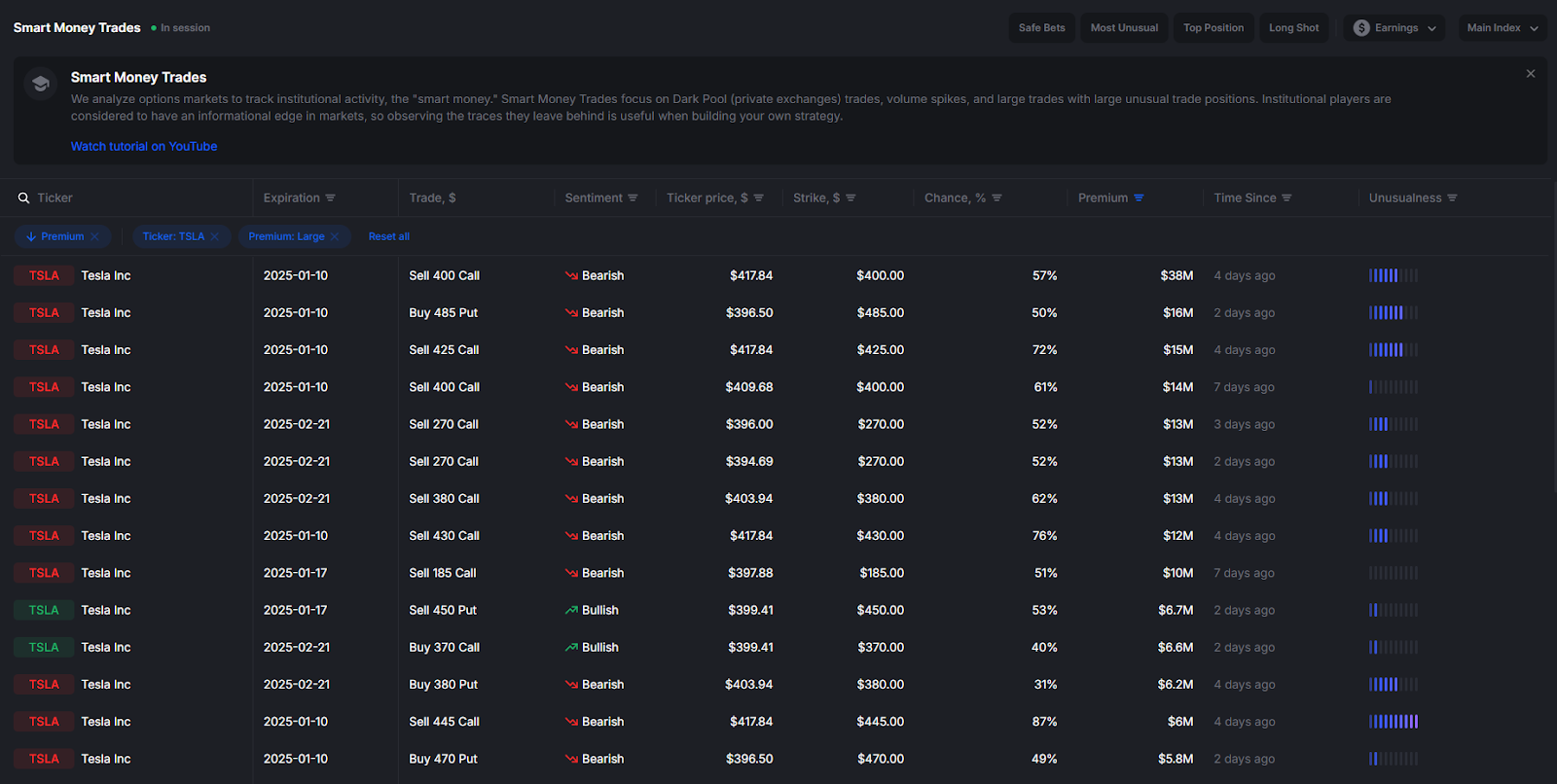

Want to stay ahead in 2025? Discover how top-performing funds are trading in real-time with TradeVision.io’s Smart Trades Tab. Simply visit https://www.tradevision.io/smart/ to explore the trades funds are actively working on right now.

Here’s how to make the most of this powerful tool:

- Sort by Unusualness Score: Use the right side of the table to rank trades by their “Unusualness” score. This highlights the most unique and potentially high-impact opportunities.

- Follow the Leaders: Gain insights into what top funds are buying or selling, and use this information to refine your own strategy.

Don’t miss out on this game-changing feature. Start tracking fund performance today and make 2025 your best trading year yet!

Final Thoughts

The best mutual funds of 2024 thrived by betting on tech giants, but 2025 could be different. As a new trader, focus on learning from these strategies, stay diversified, and be patient. Whether you’re interested in AI, energy, or small-cap stocks, there are opportunities to grow your portfolio — just make sure to do your research and invest wisely.

By understanding these trends and strategies, you’ll be better equipped to navigate the market and make informed decisions in 2025 and beyond. Happy trading!