As the trading landscape evolves, both novice and seasoned traders are facing new challenges and opportunities. With rapid advancements in technology, fluctuating global markets, and evolving financial instruments, staying ahead of the curve is more important than ever. In 2024, successful traders know that success requires more than just market knowledge; it demands a strategic approach, strong risk management practices, and the ability to adapt to an ever-changing environment.

Whether you’re a seasoned pro or just starting out, this guide provides top expert advice for becoming a successful trader in 2024, including a focus on “trader options” as a key area of growth and potential.

1. Stay Updated on Market Trends and Technology

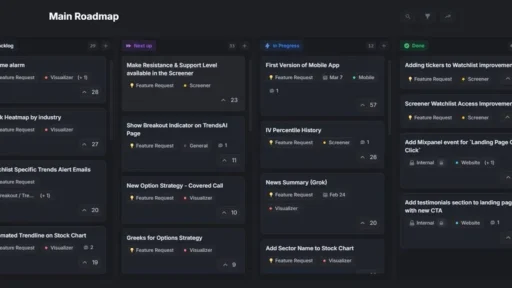

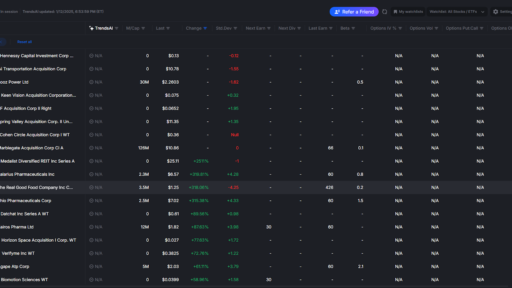

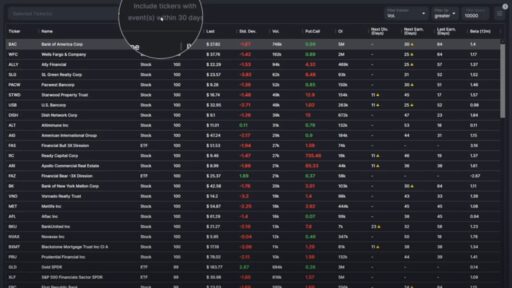

The first piece of expert advice for any trader, especially in 2024, is to stay informed. The financial markets are constantly evolving, and with the increasing role of artificial intelligence, machine learning, and blockchain, the tools you use and the market dynamics you engage with are shifting rapidly. To remain competitive, successful traders must integrate up-to-date tools and strategies into their trading practice.

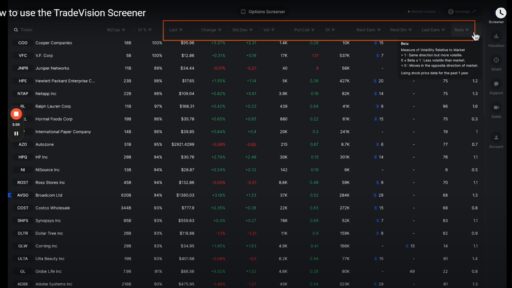

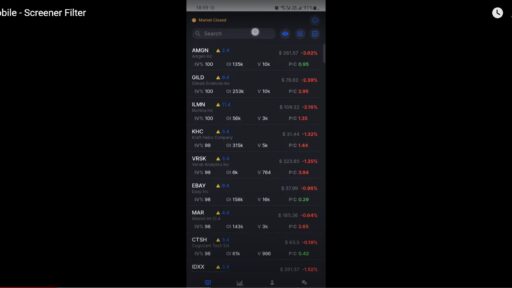

- Use AI and Data Analytics: Many professional traders are leveraging AI-powered platforms to analyze vast amounts of data quickly and accurately. These tools can help traders identify patterns and trends that would otherwise be difficult to spot. In 2024, a strong understanding of how to incorporate AI and data-driven insights into your trading strategy is a game-changer.

- Embrace New Financial Instruments: Cryptocurrencies, NFTs, and other blockchain-based assets are reshaping the market. Successful traders are learning to diversify their portfolios by incorporating these new instruments. Staying ahead of new developments and understanding their impact on the broader financial landscape will help you stay competitive.

2. Master Risk Management

No matter how talented you are as a trader, your ability to manage risk will always be the determining factor in your long-term success. Expert traders know that minimizing losses is just as important as maximizing gains. Here’s how to get your risk management right in 2024:

- Position Sizing: Knowing how much capital to risk on each trade is crucial. Never risk more than a small percentage of your total capital on any single trade. A typical recommendation is to risk no more than 1-2% of your portfolio on a single trade, which ensures that even if you experience losses, they don’t wipe you out.

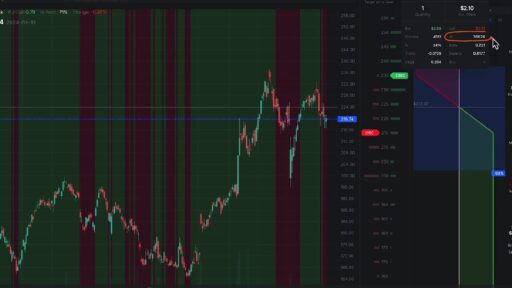

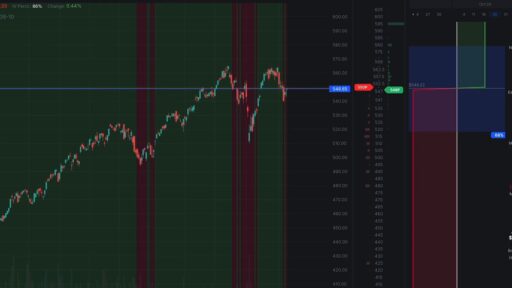

- Stop-Loss and Take-Profit Orders: Use these tools to automate your exit strategy. Stop-loss orders help you minimize losses if the market moves against you, while take-profit orders lock in your gains when the market moves in your favor.

- Diversification: Never put all your eggs in one basket. A diversified portfolio spreads risk across different assets, reducing the impact of poor performance in one area. This strategy works in both traditional stock and options trading.

3. Leverage Trader Options for Greater Flexibility

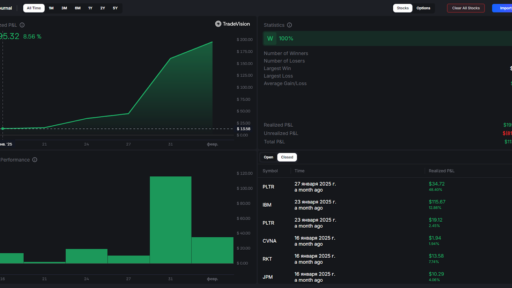

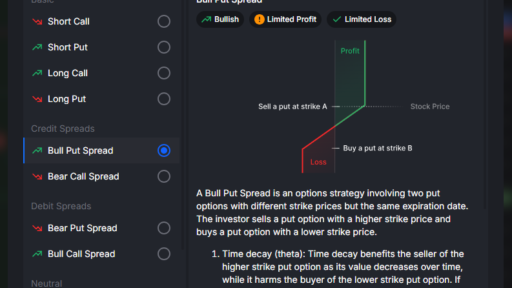

When discussing expert advice for successful traders, it’s impossible to overlook the growing popularity of trader options. Options are a powerful financial tool that can provide flexibility and the potential for high returns with limited risk if used correctly. In 2024, more traders are turning to options as a way to hedge their positions or increase returns. Here’s how you can make the most of trader options:

- Understand the Basics of Options: Options give traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a set timeframe. Options are often categorized into calls (the right to buy) and puts (the right to sell). Understanding these basics is key to effectively using options.

- Use Options for Hedging: One of the main advantages of options is their ability to hedge risk. For example, if you’re holding a stock that you think might drop in the short term, you can buy a put option as protection against potential losses. This makes options a great tool for risk management, particularly in volatile markets.

- Selling Options for Income: Experienced traders often sell options (known as writing options) to collect premiums. By selling options, you’re betting that the market will not move significantly in the direction that would cause the option to be exercised. However, writing options comes with significant risk, so it’s important to use this strategy with caution and only after understanding the risks involved.

- Trade with a Clear Strategy: Successful traders do not approach options trading with a “buy and hold” mindset. Instead, they use options for specific purposes—whether to hedge, speculate on price movements, or generate income. Define your goals before entering any options trade and be clear on your risk tolerance.

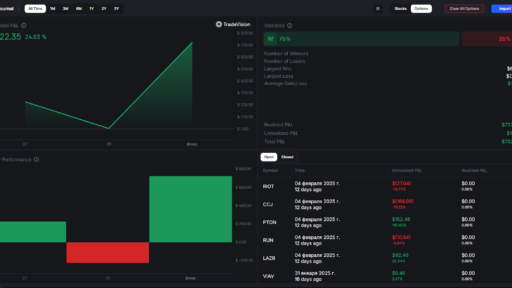

4. Develop a Robust Trading Plan

A trading plan is not just a nice-to-have—it’s essential for long-term success. Without a clear plan, it’s easy to get distracted by market noise or impulsively chase after trends. In 2024, successful traders know that having a well-defined trading strategy is essential for keeping emotions in check and making disciplined decisions.

- Set Clear Goals: Your trading plan should outline your financial goals. Are you aiming for steady, long-term growth, or are you looking for short-term profits? Your plan will shape your risk tolerance, position sizes, and the types of trades you pursue.

- Stick to Your Plan: Once you have your trading plan in place, discipline is key. Many traders make the mistake of deviating from their plan when emotions take over—whether it’s fear during a market downturn or greed when a position is making gains. Successful traders follow their plans, adjusting only when necessary based on changing market conditions.

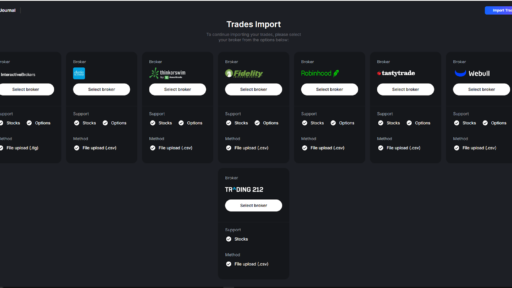

- Track and Review Your Trades: Regularly evaluate your trades and outcomes. By keeping a trading journal, you can identify what works, what doesn’t, and areas for improvement. Self-reflection is a critical part of refining your strategy and growing as a trader.

5. Focus on Emotional Control and Mental Toughness

One of the most overlooked aspects of successful trading is emotional discipline. Trading is a high-pressure activity that can elicit strong emotions—whether it’s the euphoria of a profitable trade or the stress of a losing streak. In 2024, traders are increasingly recognizing that their ability to manage emotions is just as important as their technical skills.

- Avoid Emotional Trading: Emotional decisions often lead to impulsive trading and excessive risk-taking. Establish a routine and stick to it, regardless of the market’s ups and downs. If you feel overwhelmed or stressed, it might be time to step away from the screen.

- Mindset and Resilience: Trading involves both wins and losses. Successful traders learn from their losses and view them as opportunities to grow. A resilient mindset will help you stay focused on your long-term goals and avoid getting distracted by short-term setbacks.

- Maintain a Healthy Lifestyle: Mental clarity is critical to successful trading. Get adequate sleep, exercise, and eat healthily. The demands of trading can be taxing, and a well-balanced lifestyle can help you stay focused and avoid burnout.

6. Use Simulated Trading to Sharpen Your Skills

Before diving into the live markets, many successful traders use simulated trading (also known as paper trading) to practice their strategies without risking real money. In 2024, this is especially beneficial given the complexity of new tools and instruments, including trader options.

Simulated trading environments allow you to test various strategies, fine-tune your risk management practices, and build your confidence without the emotional strain of real money on the line. Once you’re comfortable with your strategy and performance, you can transition to live trading with greater ease.

Conclusion

Success as a trader in 2024 demands a combination of skill, discipline, and adaptability. By staying updated on market trends, mastering risk management, leveraging trader options, developing a robust trading plan, and maintaining emotional control, you can enhance your chances of long-term success in the markets. Trading is a continuous learning process, so stay curious, stay disciplined, and, most importantly, be patient with yourself as you navigate the ever-evolving world of trading.

With the right approach and mindset, you can position yourself to thrive as a trader in 2024 and beyond.