Options trading for Beginners can seem daunting, especially if you’re just starting out. However, with the right strategies, you can begin to navigate the world of options with confidence. Here are five essential options trading strategies designed specifically for beginners to help you get started.

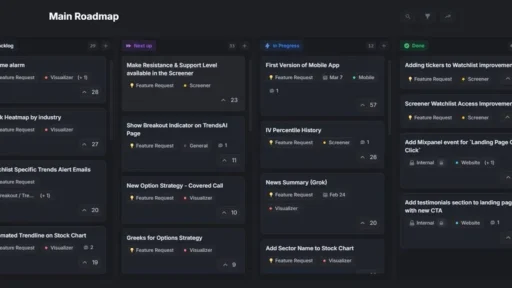

1. Covered Call

What It Is: The covered call strategy involves holding a long position in a stock while simultaneously selling a call option on the same stock. This approach allows you to generate extra income from the option premium.

Why It’s Good for Beginners: It’s a relatively low-risk strategy because the premium from the call option provides some cushion against potential losses. Plus, if the stock doesn’t rise above the strike price, you keep the premium and the stock.

How to Implement:

- Buy 100 shares of a stock.

- Sell a call option with a strike price above the current stock price.

- Collect the premium and wait. If the stock price stays below the strike price, you keep both the stock and the premium.

2. Cash-Secured Put

What It Is: This strategy involves selling a put option while having enough cash on hand to buy the stock if needed. Essentially, you’re agreeing to buy the stock at a lower price if it drops below the strike price.

Why It’s Good for Beginners: It allows you to potentially acquire stock at a discount while earning a premium for agreeing to buy the stock. It’s a conservative approach that requires careful planning and cash management.

How to Implement:

- Choose a stock you’re interested in buying.

- Sell a put option with a strike price at or below the current stock price.

- Set aside enough cash to purchase the stock if the option is exercised. If the stock price stays above the strike price, you keep the premium.

3. Long Call

What It Is: The long call strategy involves buying a call option with the expectation that the stock price will rise above the strike price before the option expires. This gives you the right, but not the obligation, to buy the stock at the strike price.

Why It’s Good for Beginners: It’s straightforward and has limited risk—the most you can lose is the premium paid for the call option. It’s a great way to leverage your investment if you anticipate a significant stock price increase.

How to Implement:

- Purchase a call option with a strike price above the current stock price.

- Wait for the stock price to rise. If it exceeds the strike price, you can either exercise the option or sell it for a profit.

4. Long Put

What It Is: The long put strategy involves buying a put option when you expect the stock price to decline. This gives you the right to sell the stock at the strike price, potentially profiting from a drop in the stock’s value.

Why It’s Good for Beginners: It’s a simple way to profit from a bearish market. Like the long call, it has limited risk, with losses confined to the premium paid for the put option.

How to Implement:

- Purchase a put option with a strike price above the current stock price.

- Monitor the stock price. If it falls below the strike price, you can sell the option for a profit or exercise it.

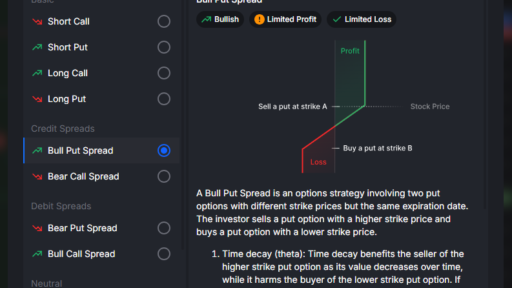

5. Vertical Spread

What It Is: A vertical spread involves buying and selling two call options or two put options on the same stock but with different strike prices. This strategy can be bullish or bearish depending on whether you use calls or puts.

Why It’s Good for Beginners: It limits both potential gains and losses, making it a controlled way to speculate on stock price movements. It’s less risky compared to buying single options and provides a defined risk/reward profile.

How to Implement:

- Bull Call Spread: Buy a call option at a lower strike price and sell a call option at a higher strike price.

- Bear Put Spread: Buy a put option at a higher strike price and sell a put option at a lower strike price.

- Monitor the stock and options. If the stock price moves as anticipated, you can profit within the defined range of your spread.

Conclusion: Options Trading for Beginners

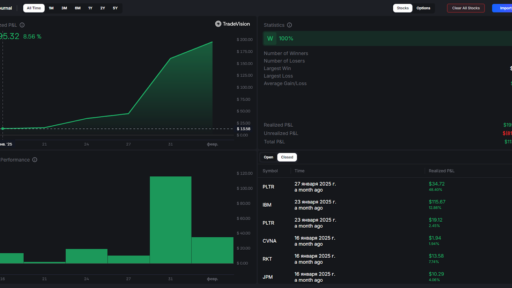

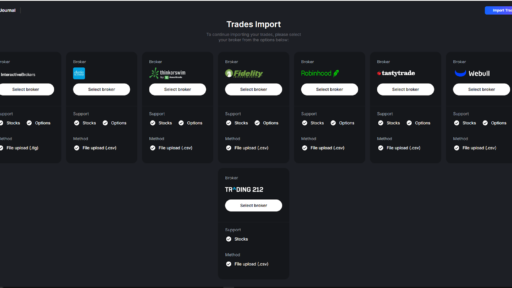

Options trading offers a variety of strategies that can suit different market conditions and risk tolerances. For beginners, starting with these five strategies—covered call, cash-secured put, long call, long put, and vertical spread—can help you build a solid foundation and gain confidence in your trading decisions. Always remember to do thorough research and consider practicing with a demo account before committing real money.

Happy trading!