If you’re looking to dive into the world of options trading, understanding strategies like strangles and straddles is crucial. These strategies can be powerful tools for traders who want to capitalize on volatility in the market. Today, I’ll walk you through how to effectively use OptionsWatch to set up these strategies and help you make informed trading decisions.

What Are Strangles and Straddles?

Before we jump into the setup process, let’s clarify what these strategies entail:

- Straddle: In a straddle, you buy a call and a put option at the same strike price and expiration date. This strategy benefits from significant price movement in either direction.

- Strangle: A strangle also involves buying a call and a put, but at different strike prices. This can lead to a broader loss zone but often comes with lower premiums than a straddle.

The reason we often combine these strategies is that they share similarities but cater to different risk tolerances and market expectations.

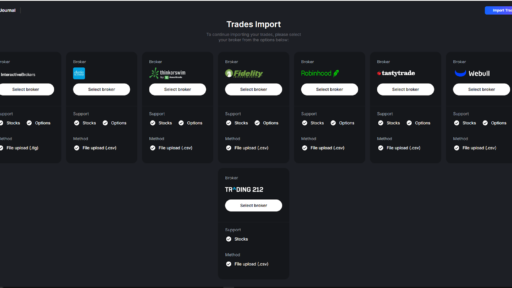

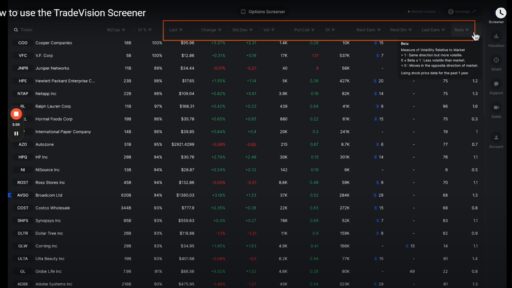

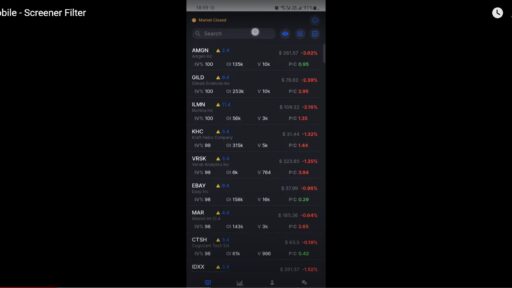

Setting Up Your Strategy in OptionsWatch

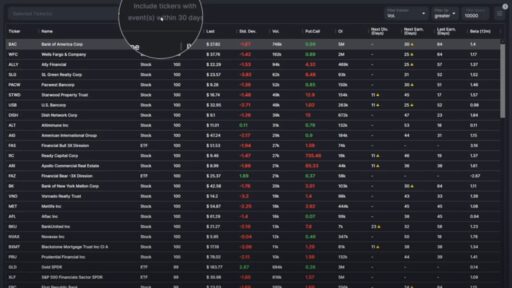

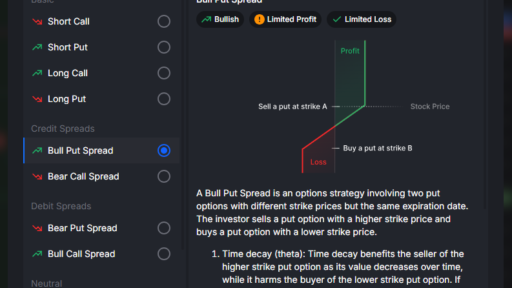

To get started, simply navigate to the strategy dropdown in OptionsWatch. Here’s how you can set up both strangles and straddles:

- Select Your Strategy: Choose either a long strangle or a long straddle based on your market outlook. A straddle typically offers a higher probability of profit, while a strangle can be a more cost-effective choice.

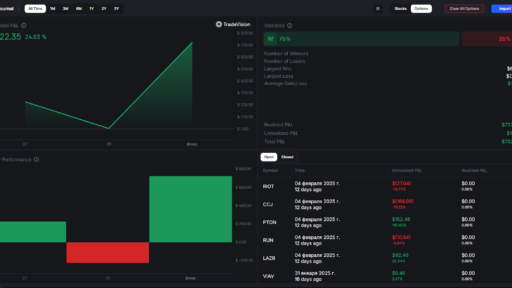

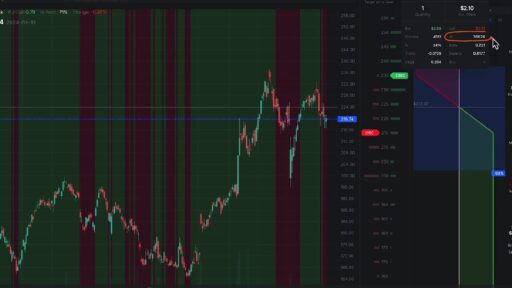

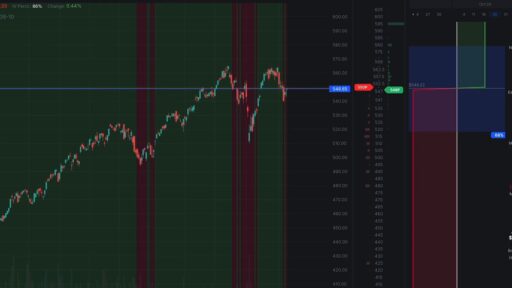

- Analyze Your Trade: Once you’ve made your selection, OptionsWatch provides a visual representation of your trade. You’ll notice the profit and loss zones, with the red area indicating your potential loss. This visual helps you understand the risks involved.

- Adjust Your Strike Prices: For straddles, since both options are at the same price, you may want to adjust your strike prices slightly to optimize your break-even points, indicated by the grey lines on the chart. For strangles, you can see how the top of the trade flattens out, widening the loss zone.

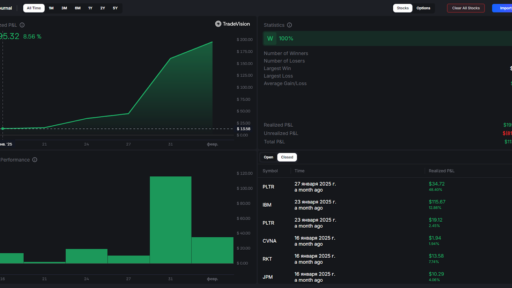

- Review Profit Potential: OptionsWatch will show you potential profits, displayed in percentage terms (e.g., 200%, 300%) alongside the dollar amounts. This is invaluable when deciding whether to proceed with the trade.

- Understand Probability and Expected Move: The platform provides probability metrics, like an 85% expected move and a 68% alternative. This information is crucial for gauging the likelihood of achieving your profit targets.

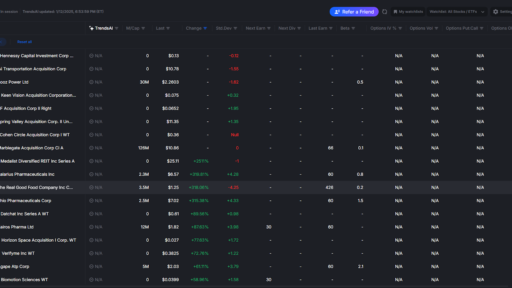

- Utilize Delta and Other Greeks: If you’re keen on technical analysis, you can click on each leg of your trade to view important metrics like delta, implied volatility (IV), theta, vega, gamma, volume, and open interest. This detailed information can guide you in selecting optimal strike prices and understanding market sentiment.

Conclusion

Using OptionsWatch to set up strangles and straddles empowers you to navigate the complexities of options trading with confidence. Whether you prefer the higher probability of a straddle or the wider potential profit zone of a strangle, this platform equips you with the necessary tools to analyze and execute your strategies effectively.

So, what are you waiting for? Dive into OptionsWatch today and start mastering your options trading strategies! Happy trading!