What Makes a Stock Recession-Proof?

Recession-proof stocks belong to companies that provide goods or services that remain in demand regardless of the economic climate. These businesses tend to have the following characteristics:

- Essential Products or Services: Companies that sell necessities—such as food, healthcare, and utilities—tend to perform well during recessions because consumers cannot easily cut back on these expenses.

- Strong Balance Sheets: Companies with low debt, high cash reserves, and consistent cash flow are better positioned to weather economic storms.

- Pricing Power: Businesses that can maintain or even raise prices during tough times without losing customers are more likely to sustain profitability.

- Defensive Sectors: Certain industries, like healthcare, consumer staples, and utilities, are considered defensive because they are less sensitive to economic cycles.

Below is a list of strong recession-proof stocks, supported by their 2022 recession performance reports:

1. McDonald’s (MCD)

McDonald’s thrives during recessions due to its affordable menu and global presence. In 2022, McDonald’s reported $23.18 billion in revenue, with over 90% of its restaurants franchised, ensuring steady cash flow.

Source: McDonald’s 2022 Annual Report

2. Caterpillar (CAT)

Caterpillar benefits from infrastructure spending, which often increases during recessions to stimulate the economy. In 2022, Caterpillar generated $59.4 billion in revenue, driven by strong demand for construction equipment.

Source: Caterpillar 2022 Annual Report

3. AbbVie (ABBV)

AbbVie’s focus on pharmaceuticals, including blockbuster drugs like Humira, ensures steady demand. In 2022, AbbVie reported $58.1 billion in revenue, with strong growth in immunology and oncology treatments.

Source: AbbVie 2022 Annual Report

4. Home Depot (HD)

Home Depot benefits from home improvement spending, which remains stable as people invest in their homes during downturns. In 2022, Home Depot reported $157.4 billion in revenue, with a 3.1% increase in comparable sales.

Source: Home Depot 2022 Annual Report

5. Walmart (WMT)

Walmart’s low prices and essential goods make it a go-to retailer during recessions. In 2022, Walmart generated $611.3 billion in revenue, with e-commerce sales growing by 12%.

Source: Walmart 2022 Annual Report

6. Mastercard (MA)

Mastercard benefits from the shift to digital payments, which accelerates during recessions. In 2022, Mastercard reported $22.2 billion in revenue, with a 12% increase in gross dollar volume.

Source: Mastercard 2022 Annual Report

7. Visa (V)

Visa’s global payment network ensures consistent transaction volumes, even during downturns. In 2022, Visa reported $29.3 billion in revenue, with a 10% increase in payments volume.

Source: Visa 2022 Annual Report

8. O’Reilly Automotive (ORLY)

O’Reilly benefits from consumers repairing older vehicles instead of buying new ones during recessions. In 2022, O’Reilly reported $14.4 billion in revenue, with a 7% increase in comparable store sales.

Source: O’Reilly 2022 Annual Report

9. ADP (ADP)

ADP’s payroll and HR services are essential for businesses, ensuring steady demand. In 2022, ADP reported $17.0 billion in revenue, with a 9% increase in employer services revenue.

Source: ADP 2022 Annual Report

10. Philip Morris (PM)

Philip Morris’s tobacco products, including its IQOS heated tobacco system, provide steady demand. In 2022, Philip Morris reported $31.7 billion in revenue, with a 9.2% increase in net revenue.

Source: Philip Morris 2022 Annual Report

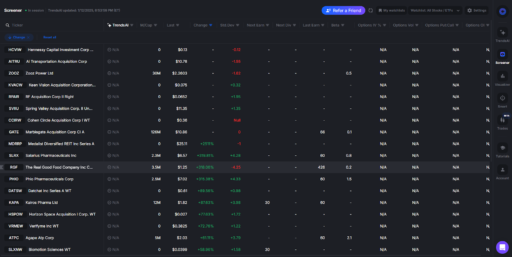

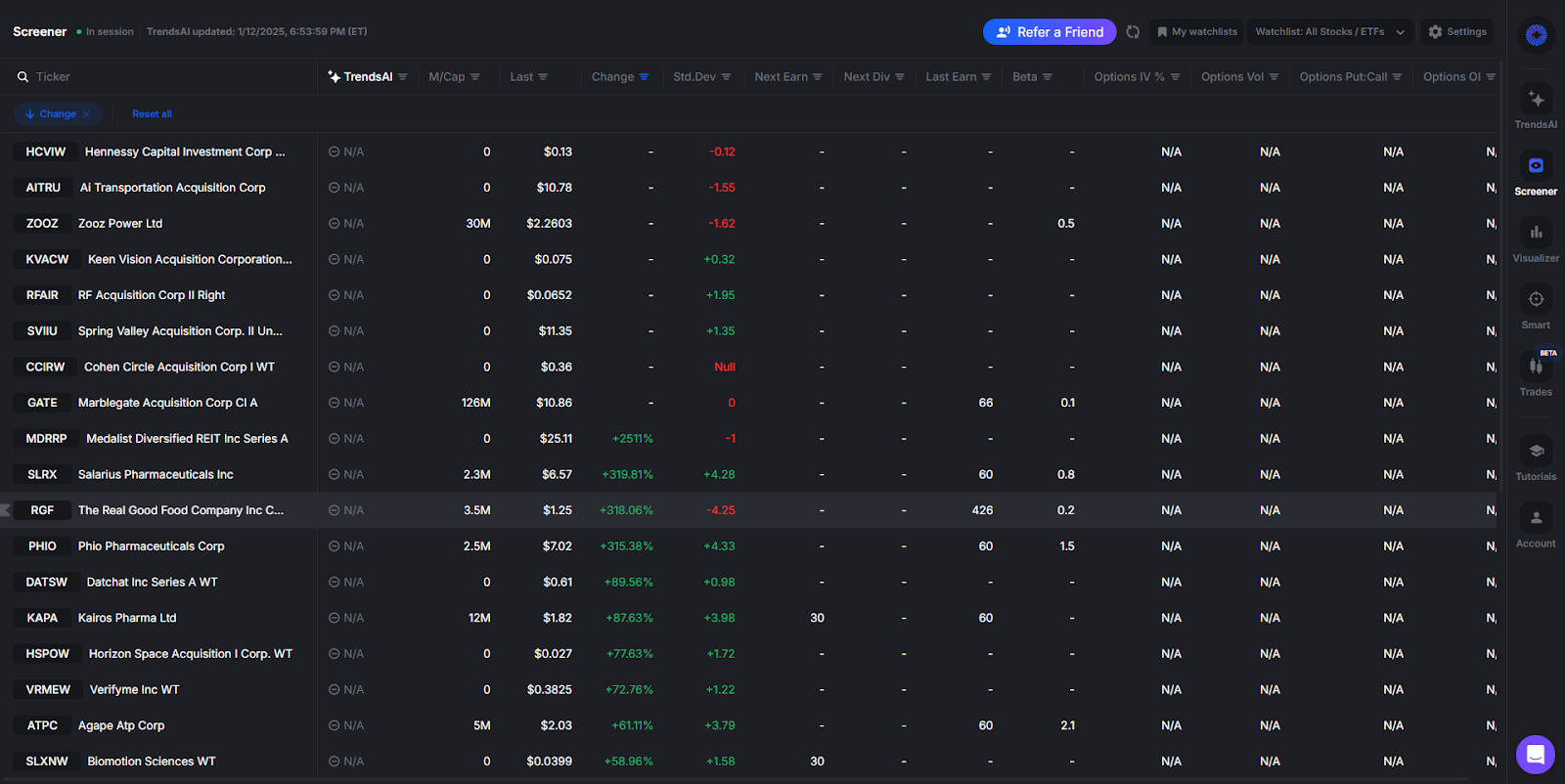

Build a watchlist in TradeVision to continuously monitor recession-proof stocks. Visit TradeVision’s Screener to get started and stay ahead of market trends.

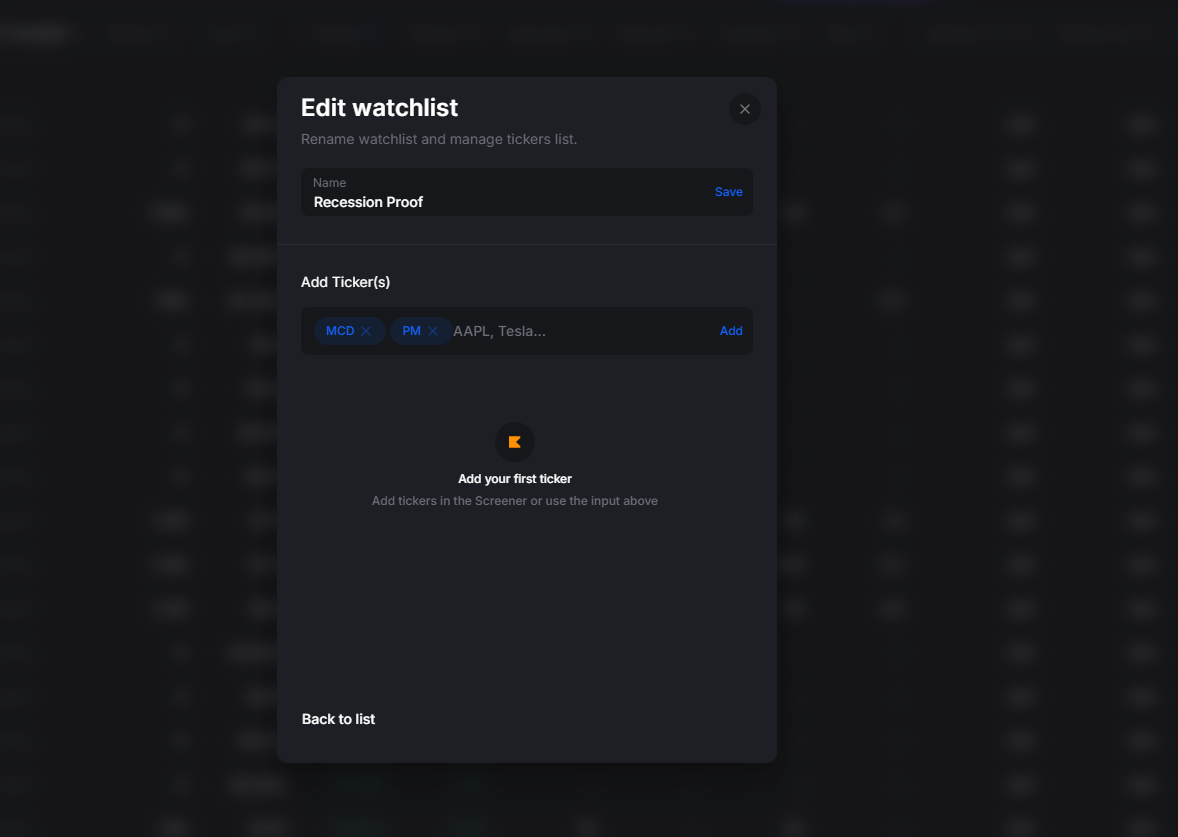

Create new Watchlist with stocks you believe are worth it:

Check them to save your money in the indecisive economy.

Tips for Building a Recession-Proof Portfolio

- Diversify Across Sectors: Don’t put all your eggs in one basket. Spread your investments across multiple recession-resistant sectors to reduce risk.

- Focus on Dividend-Paying Stocks: Companies that pay consistent dividends are often more stable and can provide a steady income stream during downturns.

- Look for Market Leaders: Established companies with strong brand recognition and market share are more likely to withstand economic pressures.

- Monitor Valuation: Even recession-proof stocks can become overvalued. Pay attention to price-to-earnings (P/E) ratios and other valuation metrics to ensure you’re not overpaying.

- Stay Invested for the Long Term: Recessions are temporary, and markets eventually recover. Avoid the temptation to panic-sell and focus on your long-term investment goals.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research or consult with a financial advisor before making investment decisions.