As global financial markets brace for a new week, several key events are set to shape investor sentiment. U.S. President Donald Trump has announced plans for fresh tariffs on steel and aluminum imports, while a crucial inflation report is due to be released. Additionally, Federal Reserve Chair Jerome Powell will testify before Congress, major corporate earnings reports will be unveiled, and gold prices have hit record highs. Here’s a detailed breakdown of the major developments to watch:

1. Trump’s New Tariffs on Steel and Aluminum

President Donald Trump’s renewed trade policy is taking center stage this week, as he moves forward with plans to impose additional tariffs on steel and aluminum imports.

- Over the weekend, while en route to the Super Bowl, Trump stated he would impose a 25% tariff on all steel and aluminum imports to the U.S.

- The official announcement is expected on Monday, followed by reciprocal tariffs on Tuesday or Wednesday, both set to take effect immediately.

- The decision follows Trump’s 10% tariffs on China, which went into effect just days ago, prompting Beijing to retaliate with its own set of levies.

- Trump had previously threatened to impose 25% tariffs on Canada and Mexico but delayed these after receiving assurances from both nations on border security.

- The largest exporters of steel to the U.S. include Canada, Brazil, Mexico, South Korea, and Vietnam, while Canada is the biggest exporter of aluminum.

- During his first term, Trump imposed 25% tariffs on steel and 10% tariffs on aluminum, but later granted duty-free quotas to allies such as Canada, Mexico, and Brazil.

Market Impact

The announcement is likely to impact global trade relations and could lead to market volatility. Investors will be watching how other countries react and whether retaliatory tariffs could escalate trade tensions further.

2. Crucial U.S. Inflation Report (CPI Data)

The most significant economic report this week will be the release of U.S. Consumer Price Index (CPI) data on Wednesday, which could influence Federal Reserve policy decisions.

- Analysts expect headline CPI to have cooled on a month-on-month basis in January but to remain consistent with December’s annualized pace.

- Core CPI, which excludes volatile food and energy prices, is projected to increase slightly compared to the prior month.

- December’s consumer prices rose by 2.9% year-over-year, exceeding the Fed’s 2% target.

Federal Reserve Watch

The data will be closely scrutinized by the Federal Reserve, which has signaled a wait-and-see approach regarding potential interest rate cuts. Any upside surprise in inflation figures could delay rate reductions and impact market expectations.

3. Fed Chair Jerome Powell’s Congressional Testimony

Federal Reserve Chair Jerome Powell will testify before Congress on Tuesday and Wednesday, offering insights into economic policy and inflation.

- Powell will have the opportunity to provide real-time analysis of the CPI data released on Wednesday.

- Lawmakers may also question him about Trump’s trade tariffs and their impact on inflation, economic growth, and financial stability.

- Over the weekend, Trump suggested that America’s $36.2 trillion debt may not be as large as reported, raising concerns about U.S. debt obligations and potential financial market disruptions.

- Powell has previously emphasized that the Fed is not in a rush to cut interest rates after multiple reductions in 2024, citing uncertainties surrounding Trump’s policy changes.

Market Implications

Powell’s testimony could shape investor expectations regarding monetary policy, inflation risks, and economic growth outlook.

4. Corporate Earnings Reports Continue

This week, investors will focus on another round of corporate earnings reports, with the quarterly reporting season now over halfway complete.

Major Companies Reporting This Week:

- McDonald’s (NYSE:MCD) – Global fast-food giant

- Coca-Cola (NYSE:KO) – Leading soft drinks manufacturer

- Cisco Systems (NASDAQ:CSCO) – Digital communications technology company

- The tech sector has already seen major earnings reports from industry titans, with analysts paying close attention to capital expenditure plans for artificial intelligence (AI).

- Nvidia (NASDAQ:NVDA), a key player in the AI space, is set to report later this month, which could serve as the next major catalyst for markets.

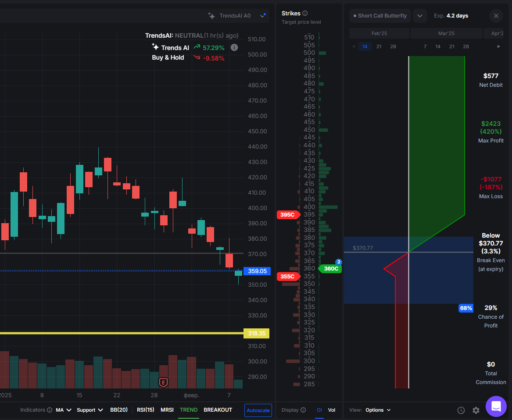

Use TradeVision to craft your next risk-free trade with our Custom Option Strategy Builder.

Market Outlook

With many earnings reports already factored into market expectations, analysts at Charles Schwab (NYSE:SCHW) suggest that no major near-term catalysts are expected from corporate earnings until Nvidia releases its results.

5. Gold Prices Surge to Record Highs

Gold prices surged to record highs on Monday, driven by safe-haven demand following Trump’s tariff announcements.

- Spot gold rose 1.4% to $2,899.26 per ounce as of 04:07 ET (09:07 GMT).

- Analysts at UBS predict gold could climb to $3,000 per ounce in the near future.

- However, further gains in gold prices are being tempered by the resilience of the U.S. dollar, as investors brace for relatively elevated interest rates.

- Economists and Fed officials have warned that Trump’s tariffs could drive inflation higher, making it less likely for the Fed to cut interest rates soon.

Investment Takeaway

With heightened geopolitical and economic uncertainty, gold’s role as a safe-haven asset continues to strengthen, making it an attractive option for risk-averse investors.