Markets React to U.S. Tariff Delays as Hopes for a China Deal Rise

Financial markets interpreted the U.S. administration’s decision to delay tariffs on Canada and Mexico by one month as a sign that negotiations remain possible—even with China.

Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum spoke with Donald Trump on Monday, affirming their commitment to strengthening border enforcement. Sheinbaum’s diplomatic approach received praise from political analysts, while investors responded with cautious optimism.

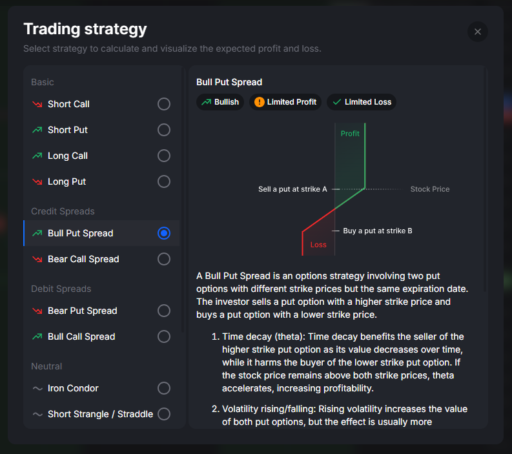

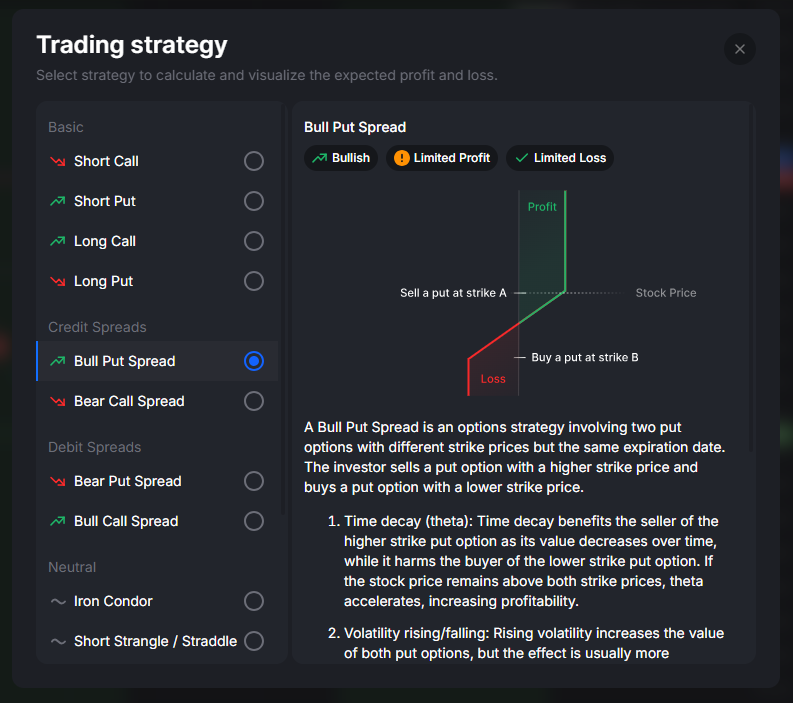

Stay ahead of the market volatility. Design your unique Trading Strategy with TradeVision powerful features:

Check out the tutorial here: TradeVision Tutorial

Stock Market & Currency Movements

Hong Kong stocks hit a two-month high, led by electric vehicle makers, as investors bet on China securing a deal to avoid the 10% U.S. tariff hike. The euro (EUR/USD) rebounded from a two-year low of $1.01 back to $1.03, reflecting reduced fears of an imminent trade war.

Meanwhile, crypto markets saw a major rebound, with traders scooping up Bitcoin (BTC/USD) and Ethereum (ETH/USD) after a steep decline.

Despite these reactions, market volatility continues to create uncertainty. J.P. Morgan’s Michael Feroli noted that recent policy shifts have increased global economic unpredictability in ways that may be difficult to reverse.

Key Earnings & Market Focus

European stock futures rose marginally by 0.1% in Asian trading, as investors awaited earnings reports from major financial firms such as Amundi (AMUN), UBS (UBSG), and BNP Paribas (BNP). Companies with tariff exposure, including Ferrari (RACE), Infineon (IFX), and Diageo (DGE), were also in focus.

Additionally, Google parent Alphabet (GOOG) is set to release earnings after market close in New York, adding another layer of anticipation for traders.

U.S.-China Trade Talks & Currency Moves

President Trump reiterated that tariffs on China will “go substantially higher” unless Beijing halts fentanyl exports to the U.S. China claims it has already cracked down on the synthetic drug trade, emphasizing that the issue is largely domestic for the U.S.

White House Press Secretary confirmed that Trump and Chinese President Xi Jinping will hold discussions in the coming days. Investors will be watching closely, especially as Chinese markets return from a week-long holiday on Wednesday. Analysts expect the yuan’s trading band to remain steady, with the offshore yuan (7.31 per dollar) still within last week’s range.

Uncertainty Over European Trade Deal

While markets speculate on potential resolutions for China and North America, Europe faces its own trade challenges. It remains unclear what kind of deal Europe could secure to avoid tariffs threatened by Trump.Meanwhile, automakers like General Motors and Ford have seen stock price swings on tariff-related news, reflecting ongoing concerns about global trade disruptions.