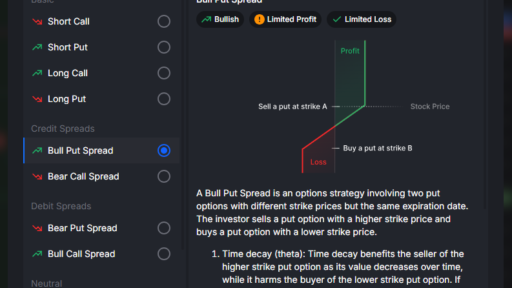

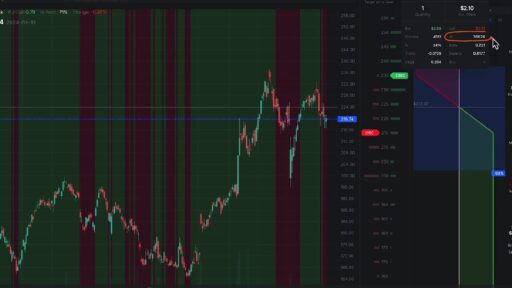

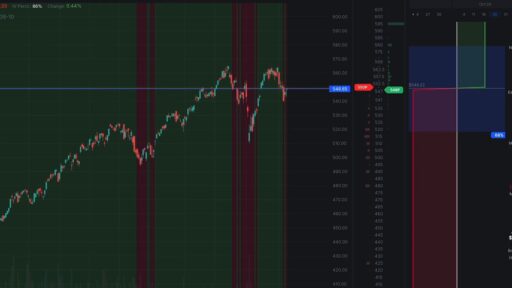

The bear call spread is an intriguing options trading strategy aimed at capitalizing on bearish market conditions. This strategy involves two key actions: selling a call option with a lower strike price and simultaneously buying a call option with a higher strike price, both expiring on the same date. By executing this trade, investors receive a net credit, as the premium from the sold option exceeds the cost of the purchased one.

Strategy Overview

At its core, a bear call spread is designed for traders who anticipate that the price of the underlying asset will either decline or remain stable. This approach is particularly attractive because it allows for limited risk and capped profit potential, making it easier for traders to manage their positions.

Mechanics of the Bear Call Spread

- Construction: To initiate a bear call spread, an investor:

- Sells a call option at a lower strike price.

- Buys a call option at a higher strike price.

- Both options share the same expiration date, which creates a structured risk profile.

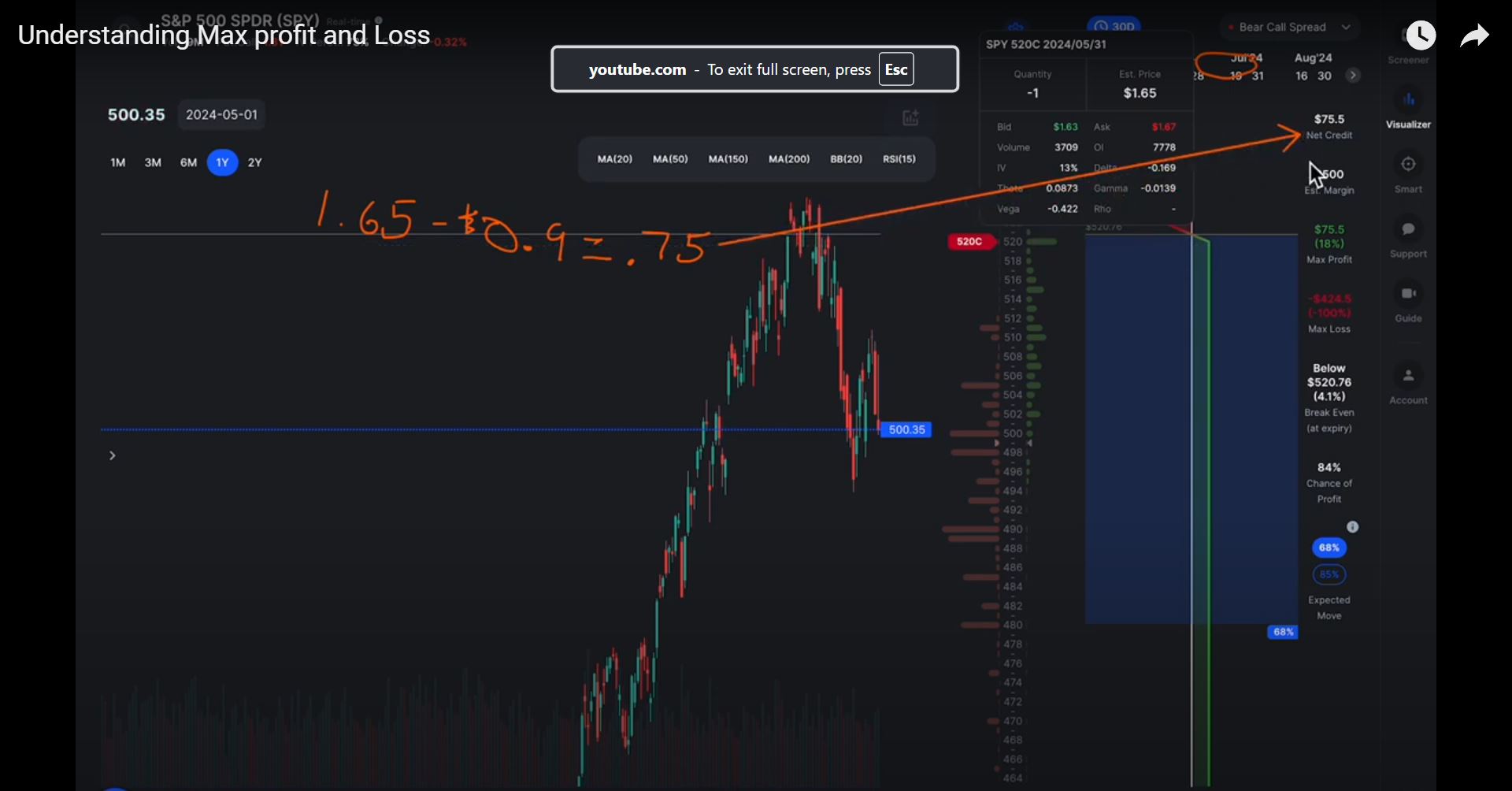

- Profit and Loss Potential:

- Maximum Profit: Achieved when the asset’s price stays below the lower strike price at expiration. The profit equals the net credit received when the spread was established.

- Maximum Loss: Occurs if the underlying price exceeds the higher strike price at expiration, calculated as the difference between the strike prices minus the net credit received.

- Breakeven Point: This is the strike price of the sold call plus the net credit, determining the threshold above which the trade incurs a loss.

Practical Examples

Consider stock XYZ, trading at $70. Here are two scenarios:

Example 1:

- Action: Sell a $70 call for $4 and buy a $75 call for $2.

- Net Credit: $2 per share.

- Maximum Gain: $200 per contract if the stock remains below $70.

- Maximum Loss: $300 per contract if the stock rises above $75.

Example 2:

- Action: Sell a $75 call for $3 and buy an $80 call for $1.50.

- Net Credit: $1.50 per share.

- Maximum Gain: $150 per contract if the stock stays below $75.

- Maximum Loss: $350 per contract if the stock exceeds $80.

Advantages of the Bear Call Spread

- Defined Risk: Traders know their maximum loss upfront, allowing for better risk management.

- Capped Profit: The potential profit is predictable, equal to the net credit received.

- Lower Capital Requirement: This strategy typically demands less margin than outright call selling due to the protective nature of the purchased call.

- Flexibility: Traders can adjust strike prices and expiration dates to align with their market outlook and risk tolerance.

Drawbacks to Consider

- Limited Profit Potential: In a strongly bearish scenario, profits are capped, which may result in missed opportunities.

- Loss Exposure: If the underlying asset moves beyond the breakeven point, losses can be realized.

- Time Decay Effects: As expiration approaches, options may lose value, which could impact the spread’s overall profitability.

- Margin Requirements: Even though risks are defined, some capital may be tied up in margin requirements, limiting trading flexibility.

Comparing Strategies: Bear Call vs. Bear Put Spread

While both the bear call spread and bear put spread are types of vertical spreads, they differ fundamentally. The bear call spread focuses on selling lower strike calls to profit from minimal upward movement or a downturn. In contrast, the bear put spread involves buying higher strike puts and selling lower strike puts, benefiting from more pronounced bearish movement.

Conclusion

The bear call spread serves as a strategic tool for traders with a cautious or bearish outlook on an asset. By understanding its structure, profit dynamics, and associated risks, investors can effectively employ this strategy to navigate fluctuating market conditions. Considerations like implied volatility and time decay are also crucial in optimizing entry and exit points, ultimately enhancing the potential success of the trade.