US equity markets surged during midday trading on Wednesday, driven by a combination of easing core inflation rates and a strong start to the fourth-quarter earnings season, particularly from large-cap banks. The positive economic data and corporate earnings reports helped push major indexes higher, with all sectors experiencing gains during the session.

Market Performance

- Nasdaq Composite: Jumped 2% to 19,420.4, led by strong performances in the technology and communication services sectors.

- S&P 500: Rose 1.3% to 5,919.5, with consumer discretionary, financials, and communication services among the top-performing sectors.

- Dow Jones Industrial Average: Gained 1.3% to reach 43,067.1, supported by robust earnings from key financial institutions.

Inflation Data Eases Pressure on the Fed

The Bureau of Labor Statistics released December inflation data on Wednesday, which showed a moderation in core inflation. This development has reduced pressure on the Federal Reserve to maintain a hawkish stance on monetary policy, providing a boost to investor sentiment.

- Core CPI (Month-over-Month): Increased by 0.2%, below the Bloomberg consensus estimate of 0.3% and down from November’s 0.3% gain.

- Headline CPI (Month-over-Month): Rose 0.4%, in line with expectations, following a 0.3% increase in November.

- Core CPI (Year-over-Year): Slowed to 3.2% in December from 3.3% in November.

- Headline CPI (Year-over-Year): Increased to 2.9% in December, up from 2.7% in November.

The softer inflation figures led to a decline in US Treasury yields, reflecting market expectations that the Federal Reserve may adopt a more accommodative policy stance in the coming months. The two-year Treasury yield fell 8.9 basis points to 4.28%, while the 10-year yield dropped 12.1 basis points to 4.67%.

Earnings Season Kicks Off on a High Note

The fourth-quarter earnings season began with strong results from major financial institutions, contributing to the market’s upward momentum.

- Goldman Sachs (GS): Shares surged 5.3% after the company reported higher-than-expected Q4 earnings and net revenue.

- BlackRock (BLK): Gained 4% following year-over-year increases in Q4 adjusted earnings and sales.

- Citigroup (C): Shares jumped 7.6% after the bank reported a swing to profit in Q4, driven by a significant increase in revenue compared to the previous year.

Tech and Healthcare Stocks Shine

In the technology sector, Intuitive Surgical (ISRG) was a standout performer, with shares rising 7.1% after the company reported preliminary Q4 revenue of

2.41 billion, well above the 1.93 billion recorded a year earlier, surpassing analysts’ expectations of $2.2 billion.

What This Means for New Traders

For new traders, today’s market activity highlights several key lessons:

- Inflation and Monetary Policy: Inflation data plays a critical role in shaping market sentiment and influencing the Federal Reserve’s policy decisions. Lower inflation rates can ease fears of aggressive rate hikes, which is generally positive for equities.

- Earnings Season Impact: Corporate earnings reports can significantly impact stock prices, especially for large-cap companies. Positive earnings surprises often lead to sharp price movements, as seen with Goldman Sachs, BlackRock, and Citigroup.

- Sector Rotation: Understanding which sectors are leading the market can help traders identify opportunities. Today, financials, consumer discretionary, and communication services were among the top performers.

- Market Breadth: When all sectors are rising, it indicates broad-based market strength, which can provide confidence to traders and investors.

Looking Ahead

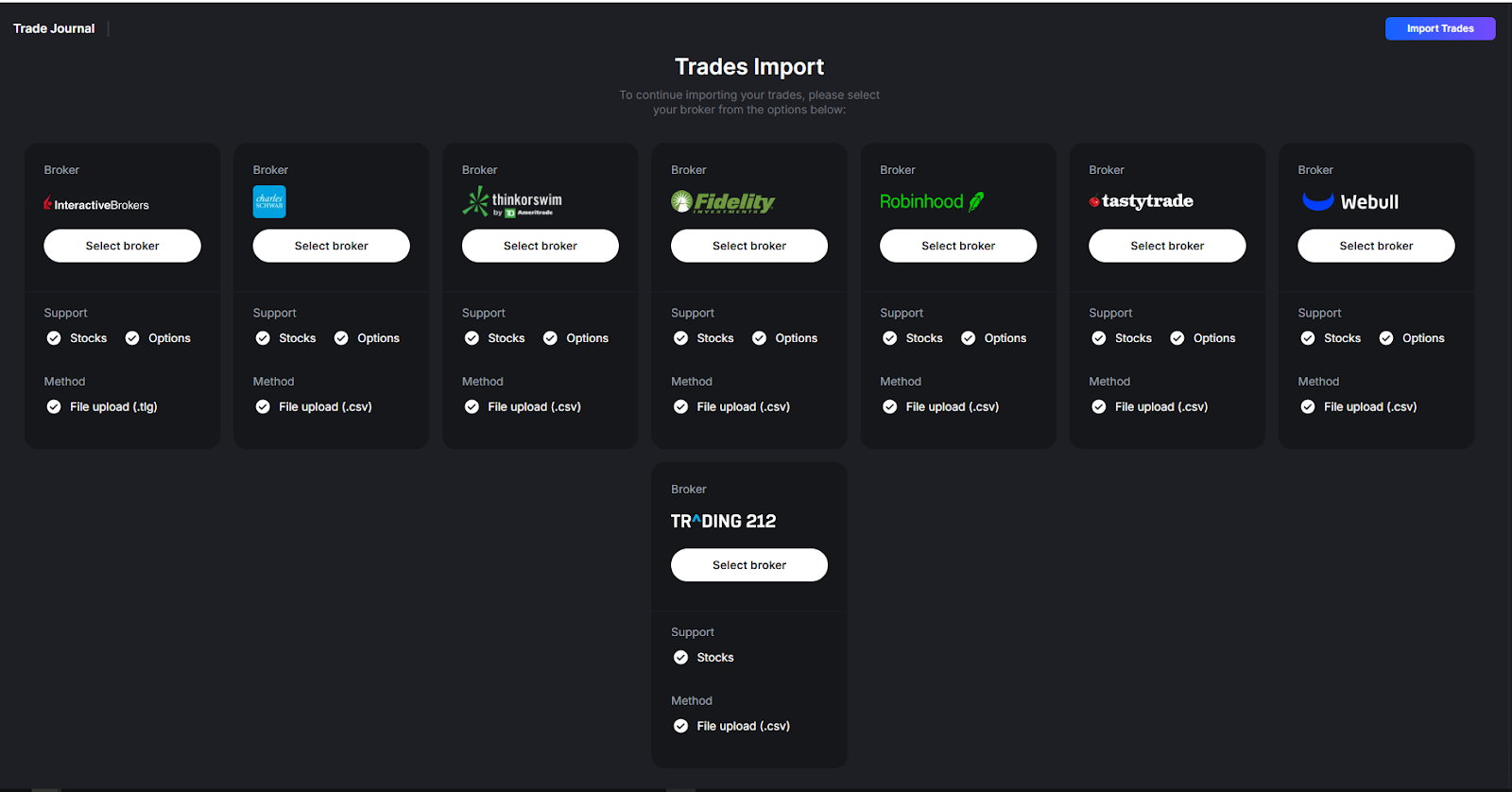

Monitor and manage your trades effortlessly with the user-friendly and intuitive interface of tradevision.io Portfolio Tracker. This powerful tool is designed to help you stay on top of your investments, providing clear insights and easy navigation to optimize your trading strategy. Whether you’re a beginner or an experienced trader, tradevision.io makes tracking your portfolio simple and efficient.

The platform features a diverse selection of brokers, offering traders a wide range of options to suit their individual needs. Here’s the full list of brokers available:

- Interactive Brokers

- Charles Schwab

- Thinkorswim

- Fidelity

- Robinhood

- tastytrade

- Webull

- Trading212

For those new to trading, staying informed about macroeconomic trends, corporate earnings, and sector performance is essential for making well-informed investment decisions. Today’s market action underscores the importance of keeping a close eye on these factors as they can significantly influence market dynamics.