Trading in financial markets can be both exciting and lucrative, but for beginners, it can also seem overwhelming. The complex terminology, the variety of trading types, and the ever-changing market conditions can leave newcomers feeling lost. However, with the right approach and knowledge, anyone can start trading successfully.

This guide is designed to provide beginners with a solid foundation on how to get started in trading, covering essential concepts, trading types, strategies, tools, and risk management.

What is Trading?

At its core, trading involves buying and selling assets, such as stocks, commodities, currencies, or cryptocurrencies, to make a profit. The key goal is to buy low and sell high, or vice versa, depending on the type of trading you’re engaging in. It’s important to note that trading is different from investing—while investing typically involves long-term holding of assets, trading is more focused on short-term gains.

For beginners, understanding the fundamental concepts is essential before diving in. Trading involves analyzing market conditions, choosing the right assets, executing buy or sell orders, and managing risk.

Types of Trading

There are several different types of trading, each with its unique approach, timeframes, and risks. As a beginner, it’s important to understand these types and decide which one suits your goals, risk tolerance, and available time.

1. Day Trading

Day trading involves buying and selling financial instruments within the same trading day, often multiple times a day. Traders close all their positions before the market closes to avoid overnight risk. Day trading requires quick decision-making, deep market knowledge, and constant monitoring of the market. It’s not for the faint of heart but can be profitable for those who are disciplined and experienced.

Pros:

- Potential for quick profits.

- No overnight risk.

Cons:

- High stress and requires constant attention.

- Can lead to significant losses if not carefully managed.

2. Swing Trading

Swing trading involves holding positions for several days or weeks to capture short- to medium-term price movements. Swing traders use technical analysis to identify price patterns and trends, entering and exiting positions based on anticipated price swings.

Pros:

- Requires less time than day trading.

- Potential for higher returns than long-term investing.

Cons:

- Overnight and weekend risks.

- Can be challenging for beginners to time trades effectively.

3. Position Trading

Position trading is the opposite of day trading—it involves holding assets for long periods, ranging from several weeks to years. Position traders focus on the fundamental factors driving asset prices rather than short-term market fluctuations.

Pros:

- Lower stress since trades are held for longer periods.

- Potential for significant long-term returns.

Cons:

- Requires a deep understanding of the market and patience.

- Long exposure to market risk.

4. Scalping

Scalping is one of the quickest forms of trading, where traders aim to make small profits on small price changes, often within minutes. Scalping requires a high level of precision, fast execution, and the ability to make decisions quickly.

Pros:

- Frequent profits if done right.

- Minimal exposure to market risk.

Cons:

- Very stressful and requires constant attention.

- High transaction costs due to the frequency of trades.

5. Cryptocurrency Trading

Cryptocurrency trading involves buying and selling digital currencies, such as Bitcoin, Ethereum, or smaller altcoins. Cryptocurrency markets are highly volatile and operate 24/7, making them an attractive but risky option for traders.

Pros:

- High potential returns due to volatility.

- Access to a global market.

Cons:

- Extreme volatility can lead to significant losses.

- Regulatory uncertainty in some countries.

Key Concepts Every Beginner Should Know

Before diving into any type of trading, it’s important to understand some fundamental concepts that apply across all forms of trading.

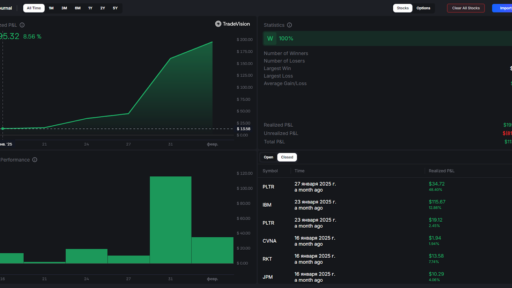

1. Risk Management

Risk management is one of the most crucial aspects of trading. No matter how skilled you become, losses are inevitable. The goal is to minimize those losses and protect your capital. To manage risk effectively, you should:

- Use stop-loss orders: This automatically sells an asset when its price falls to a certain level, limiting your losses.

- Diversify: Don’t put all your money into a single trade or asset. Spread your investments to reduce overall risk.

- Only risk what you can afford to lose: Trading should never jeopardize your financial security.

2. Leverage

Leverage allows traders to control a larger position with a smaller amount of capital. For example, using 10:1 leverage means you can control $10,000 with just $1,000 of your own money. While leverage amplifies profits, it also increases the risk of significant losses. Beginners should approach leverage with caution and only use it after gaining experience.

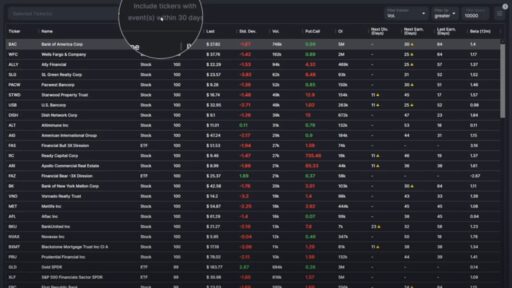

3. Technical Analysis

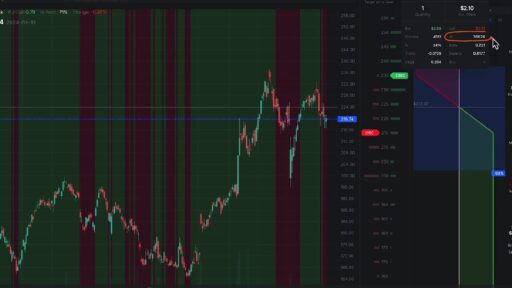

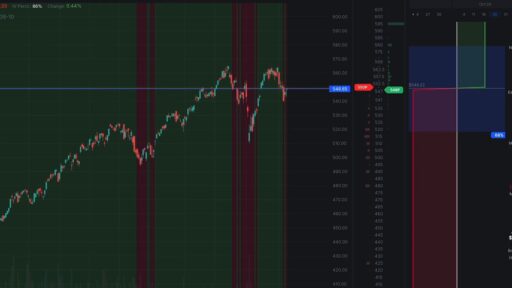

Technical analysis involves analyzing price charts, patterns, and technical indicators to predict future price movements. Common tools include:

- Moving Averages: Help identify trends.

- Relative Strength Index (RSI): Measures the strength of a price movement.

- Candlestick Patterns: Offer insights into market sentiment.

4. Fundamental Analysis

Fundamental analysis focuses on evaluating the intrinsic value of an asset by examining economic factors, earnings reports, interest rates, and news. For instance, when trading stocks, investors may analyze company earnings, leadership, market position, and future growth prospects.

Trading Strategies for Beginners

While there’s no one-size-fits-all approach to trading, there are certain strategies that can help beginners get started. Below are a few beginner-friendly trading strategies:

1. Trend Following

One of the simplest strategies for beginners is trend-following. This involves identifying and trading in the direction of the current market trend. For instance, if the price of a stock is trending upward, a trend-following strategy would involve buying the asset in hopes of profiting from the continuation of the upward movement.

How to Implement:

- Use moving averages to identify trends.

- Buy when the price is above a moving average and sell when it’s below.

2. Breakout Trading

Breakout trading involves entering a position when an asset breaks out of a defined range or pattern. For example, when a stock breaks through a resistance level, it might signal a good buying opportunity.

How to Implement:

- Identify key support and resistance levels on a price chart.

- Place orders just above resistance (buy) or just below support (sell).

3. Range Trading

Range trading is a strategy that works well in sideways markets where an asset’s price fluctuates within a set range. Traders buy when the price hits the support level and sell when it hits the resistance level.

How to Implement:

- Identify the range within which the asset’s price is fluctuating.

- Buy at support and sell at resistance.

Tools for Beginner Traders

As a beginner, you’ll need some essential tools to help you trade effectively. Here are some of the most important ones:

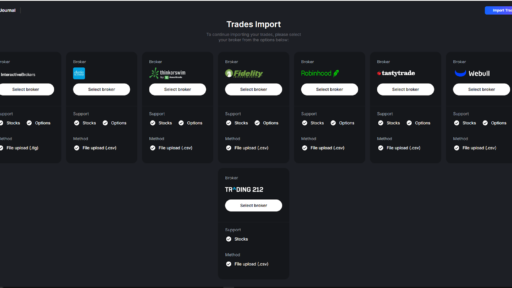

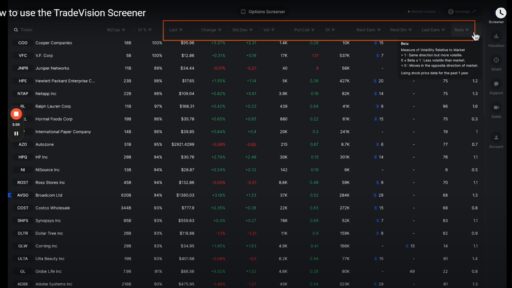

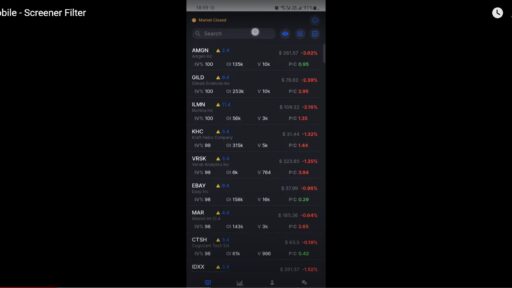

1. Trading Platforms

Choose a reliable and user-friendly trading platform. Some of the most popular platforms include:

- MetaTrader 4 or 5: A widely used platform for forex and CFD trading.

- Robinhood: A commission-free trading app for stocks and cryptocurrencies.

- eToro: Known for its social trading features, where you can copy successful traders.

2. Economic Calendar

An economic calendar is a tool that provides information on upcoming economic events, news releases, and earnings reports. Market-moving news such as economic data, interest rate decisions, and geopolitical events can affect the prices of assets. Keeping track of these events can help you plan your trades.

3. Demo Accounts

Most trading platforms offer demo accounts, where you can practice trading with virtual money. This is an excellent way to test strategies and become familiar with the platform before risking real money.

Common Mistakes Beginners Make in Trading

- Overleveraging: Using too much leverage can amplify losses quickly, especially for beginners. Start with small leverage or no leverage until you gain more experience.

- Chasing Losses: Many beginners try to “chase” their losses by taking higher risks. This often leads to more significant losses.

- Lack of Patience: Trading isn’t about getting rich quickly. It requires discipline, patience, and practice. Don’t expect instant success.

- Ignoring Risk Management: Failing to set stop-loss orders or not managing risk properly is a common mistake that can lead to large losses.

Conclusion

Trading is a skill that takes time, practice, and learning. As a beginner, it’s essential to start small, educate yourself, and gradually build your trading skills. Choose a trading style that fits your lifestyle, risk tolerance, and goals. Implement sound risk management techniques, and remember that trading is not about winning every trade—it’s about making more winning trades than losing ones over time.

With patience, discipline, and the right mindset, you can become a successful trader. Keep learning, stay disciplined, and always manage your risks carefully.