Airbnb Expands Beyond Core Markets, Driving Global Growth

Airbnb is making strategic moves to diversify its business and extend its global reach. The online short-term rental marketplace reported a profitable quarter and revealed plans to invest in regions beyond its five core markets—namely the U.S., Canada, the U.K., Australia, and France. This expansion will focus on bolstering domestic and cross-border travel opportunities in Asia and Latin America, where demand for short-term rentals is surging.

To support this ambitious growth strategy, Chief Financial Officer Ellie Mertz announced that Airbnb will increase its workforce in 2025, aligning with new business initiatives. The company plans to allocate between $200 million and $250 million to fund these expansions. Investors responded positively to Airbnb’s forward-looking approach, sending its shares soaring by 14% on Friday.

Lyft Faces Challenges Amid Declining Ride Volumes

Lyft is navigating some roadblocks as it prepares for slower growth in bookings. On Tuesday, the ride-hailing company signaled a weaker-than-expected outlook, citing a downturn in ride volume and pricing since the fourth quarter. According to Chief Financial Officer Erin Brewer, Lyft users have been opting for fewer and shorter rides post-holiday season, contributing to the company’s tempered projections.

Further complicating matters, Lyft’s long-standing exclusive partnership with Delta Air Lines has ended, with Uber securing a new deal in its place. Despite reporting a quarterly increase in revenue and a 10% rise in active riders, Lyft’s disappointing guidance led to a 7.9% drop in its stock price on Wednesday.

Coca-Cola Adapts to Tariff Pressures, Reports Strong Earnings

Coca-Cola is implementing strategic measures to manage rising aluminum costs following new tariffs imposed by the U.S. government. The beverage giant posted better-than-expected earnings on Tuesday, with organic revenue climbing 14% and global sales volume increasing by 2%.

CEO James Quincey acknowledged the potential impact of the newly imposed 25% tariff on imported steel and aluminum, signed into law by former President Donald Trump. Since Coca-Cola imports aluminum from Canada for its U.S. soda cans, the company is exploring alternative sourcing strategies and material efficiency improvements to mitigate cost increases. Investors responded positively to the earnings report, driving Coca-Cola shares up by 4.7% on Tuesday.

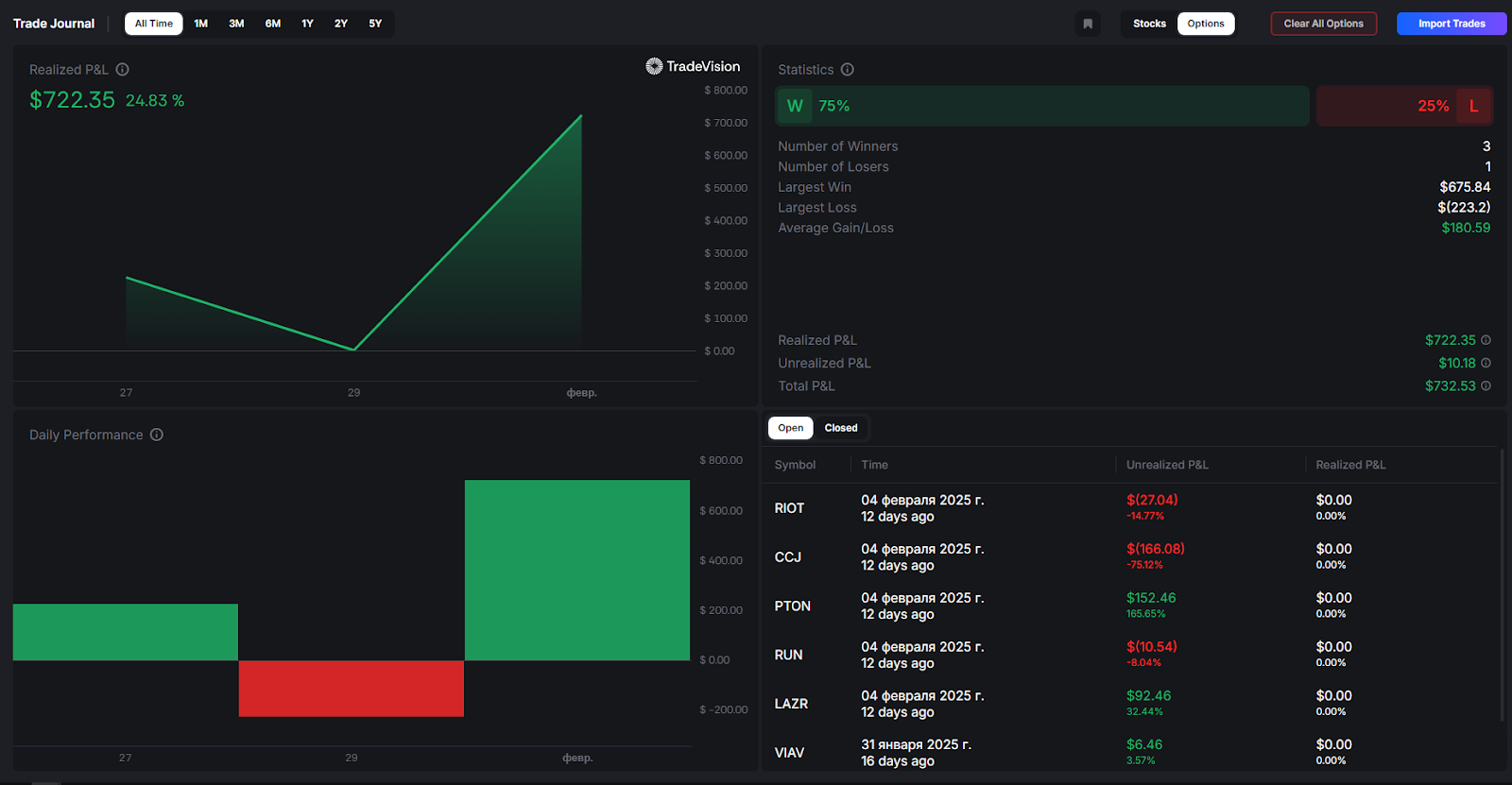

Build Your Own Trading Strategy with TradeVision and Fast-Track Your Path to Financial Independence!”

- Develop a Winning Trading Plan: Learn how to analyze markets, set clear goals, and create a strategy that aligns with your risk tolerance and financial aspirations.

- Master Risk Management: Protect your capital by implementing smart risk management techniques, such as stop-loss orders, position sizing, and portfolio diversification.

- Leverage Market Trends: Stay ahead of the game by understanding technical and fundamental analysis to identify profitable opportunities.

Alibaba’s AI Partnership with Apple Lifts U.S. Shares

Alibaba’s U.S.-traded shares surged following reports of a potential artificial intelligence partnership with Apple. The Wall Street Journal revealed that Apple recently submitted its Apple Intelligence AI features—developed in collaboration with Alibaba—for regulatory approval in China.

Apple Intelligence, the tech giant’s latest AI-powered tool, includes an enhanced Siri voice assistant, advanced text-generation capabilities, and next-level photo-editing features. Due to Chinese regulations, Apple must partner with local tech firms to bring generative AI services to the country. Alibaba’s Qwen chatbot and AI-driven e-commerce tools are expected to play a crucial role in this partnership.

The anticipation of Apple and Alibaba’s collaboration boosted American depositary receipts of Alibaba by 4.9% on Wednesday.

Robinhood’s Crypto Boom Fuels Record-Breaking Q4 Earnings

Robinhood Markets saw a remarkable financial boost in the fourth quarter, thanks to a surge in cryptocurrency trading. The company reported a sharp rise in net income, totaling $916 million—up from just $30 million a year prior. Revenue more than doubled, reaching $1.01 billion and surpassing Wall Street’s expectations.

The trading platform benefited significantly from a postelection market rally, often referred to as the “Trump bump,” as investors reacted to anticipated business-friendly policies. The strong performance led to a 14% jump in Robinhood’s stock price on Thursday.

Unilever to Spin Off Ice-Cream Business, Impacting Global Strategy

Unilever, the multinational consumer goods company, announced plans to spin off its ice-cream division, including popular brands such as Ben & Jerry’s, Magnum, Breyers, and Talenti. The company selected Amsterdam as the primary listing location for the new standalone business, bypassing London and New York.

Despite the restructuring, Unilever’s latest earnings report showed underwhelming revenue growth, driven in part by a decline in sales in China, where economic uncertainty has weakened consumer sentiment. The company also issued a cautious outlook for 2025, leading to a 5.6% drop in its American depositary receipts on Thursday.

Conclusion

Airbnb’s aggressive expansion, Alibaba’s AI partnership, and Robinhood’s crypto-driven success highlight the dynamic shifts in the global business landscape. Meanwhile, companies like Lyft, Coca-Cola, and Unilever face unique challenges that will shape their strategic decisions moving forward. Investors remain watchful as these industry leaders adapt to changing market conditions and emerging opportunities.