Education sparks confidence in new traders. Blend learning with hands-on practice. Craft a solid strategy. Navigate the market’s complexities step by step. Start small, gain experience. Analyze trends, manage risks. Get information piece by piece, constructing a foundation of understanding. Stay informed on economic shifts. Set realistic goals. Embrace patience as you grow. With time, trading becomes second nature. Your journey to stock trading success begins now.

Commit to Learning for Stock Trading Success

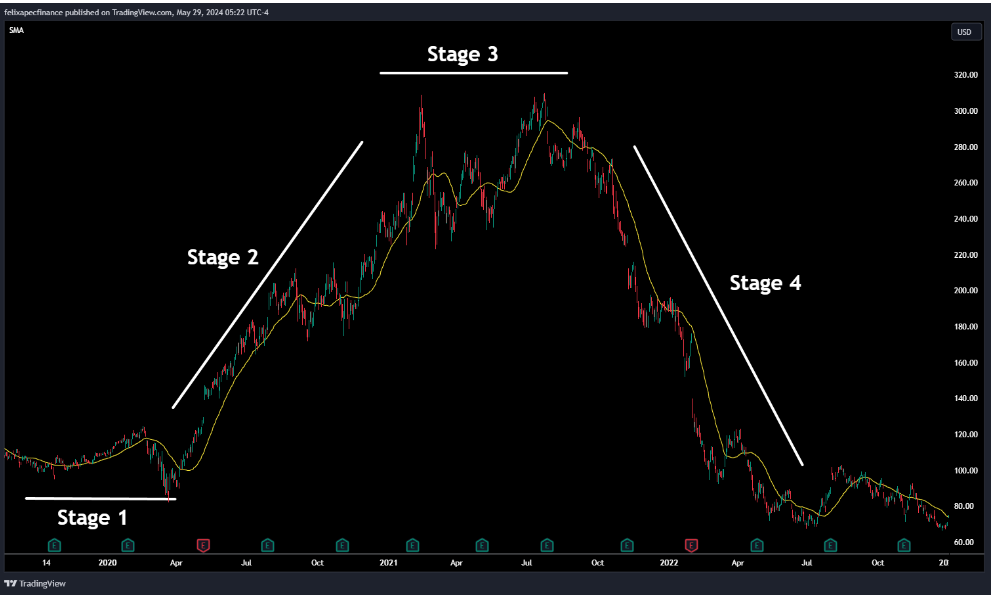

Take the time to understand the basics of stock trading. Charts reveal price patterns, while balance sheets unveil financial health. Savvy investors master both technical and fundamental analysis. Books and online courses offer crucial knowledge. Dive in, study hard, and watch your investing skills soar. Success awaits those who blend chart-reading prowess with deep company insights. For more information, check out our guide on Stock Trading Success.

Create a Trading Strategy for Stock Trading Success

Develop a comprehensive trading plan that includes your goals, risk tolerance, and strategies. Define your criteria for entering and exiting trades. Stick to your plan to avoid impulsive decisions. Consistency in your approach is key to stock trading success. Learn more about building a strong plan with our Trading Strategy Tips.

Stay Updated on Market Trends for Stock Trading Success

Market savvy leads to smart trades. Stay updated on economic indicators, earnings, and industry news. These insights shape stock prices and inform your decisions. Knowledge is power in the ever-changing financial landscape, making it crucial for achieving stock trading success.

Open Your Brokerage Account

Select an online broker that offers simplicity, affordability, and educational resources. Practice risk-free trading using virtual money in demo accounts. Choose a brokerage that matches your trading aims. Look for a platform that is easy to use. Practice first, then invest real money. Make a precise selection to avoid a complicated market debut. Smart selection paves the way for stock trading success.

Practice with a Paper Trading Account

Before risking real money, practice with a paper trading account. This allows you to test and refine your strategies without financial risk. Most brokers offer this feature, helping you gain experience and build confidence in your trading abilities.

Set a Realistic Trading Budget

Establish a solid trading budget to guide your investments. Divide your portfolio into segments, allocating no more than 10% to one stock. Only use funds that you can afford to lose, and keep your essential expenses separate.

Understand Order Types

Knowing how to use different order types is essential for effective trading. Here are the two main types:

Market Orders: These execute buys or sells at the current market price.

Limit Orders: Control your trades with precision. Set a specific price or better for buying and selling. These orders offer enhanced execution flexibility.

Start with Small Investments

Start small and focused. Trade fractional shares to diversify cheaply. Manage risk by tracking a few stocks closely. This strategy lets you invest wisely in pricier companies without breaking the bank. As your skills grow, so can your portfolio.

Be Cautious with Penny Stocks

Diversified ETFs and blue-chip stocks offer safer investment options than penny stocks. Despite their allure, cheap shares often carry significant risks. Limited trading volume can make selling difficult. Established companies provide more stability and liquidity for investors seeking long-term growth.

Track and Review Your Performance

Regularly evaluate your trades and overall performance. Analyze which strategies were successful and which weren’t and adjust your trading plan accordingly. Continuous learning and adaptation are crucial for long-term stock trading success.

Patience and discipline pave the way for trading success. Novices can forge a robust base by heeding key principles. Balance risk and reward wisely as you hone your craft. Time breeds expertise, so stay the course. Your trading acumen will flourish with consistent effort and measured steps.